Photo from www.arttoday.com ©2002.

Neither of these books is about journalism. Yet, together, they get to the heart of journalism’s current malaise. In one book, our heart is scrutinized; in the other, it is our head.

The absence of heart is examined by author and law professor Lawrence Mitchell. He helps us see how the conflict between advocates of quality journalism and Wall Street minimalists is embedded in a larger systemic flaw in the artificial person known as the corporation. The American political and legal system has designed the corporation for just one goal—to maximize shareholder value. Like a real person, it has to pay the costs of seeking that goal, but unlike a human decision-maker, it does not have to feel those costs at an emotional or empathetic level. Though the language Mitchell employs is more refined, what he says is that the corporation has no soul to damn and no ass to kick.

The corporate use of numbers is also irrational, in ways outlined in a much broader frame by David Boyle, who is a London-based writer on economics for The Guardian and New Statesman. In his book, “The Sum of Our Discontent,” Boyle speaks to what makes sense in our heads as he presents a simple argument: We have come to love numbers too much and in so doing we have developed the habit of giving disproportionate weight to variables that are easy to measure. Conversely, we tend to ignore important things when they are hard to measure.

Like me, Boyle is a numbers man, but it takes getting through the first two-thirds of his book before a reader realizes this. At first, I feared that his work would fuel the fears of graduate students in my required course on quantitative research methods who keep looking for rationalizations to avoid rigorous counting and measuring. Fearful they’d use Boyle to reinforce those rationalizations, I made a preemptive strike by making the book required reading.

My strategy worked, because Boyle eventually admits that to make his case that numbers are used irrationally, he has to use quantitative arguments. For example, the U.S. Census was used to justify racism in antebellum USA. The 1840 census seemed to show that free blacks in the North had higher rates of insanity than southern slaves. It turned out to be an artifact of the data collection system.

Mitchell, a law professor at George Washington University, echoes Boyle when he writes that “You manage what you measure,” and accuses corporations of irrationally focusing on quarterly earnings per share as the main test of shareholder value. They do it because the reward system for investment analysts is based on short-term performance. In fact, writes Mitchell, invoking the name of investment guru Warren Buffett, “quarterly changes in performance are close to meaningless, and even annual changes, though somewhat more revealing, are not of earth-shattering importance.”

One of the radical solutions Mitchell proposes is to stop requiring quarterly reports. And his book was written before the post-Enron investigations highlighted the many ways that companies and their accountants use those reports to mislead us. Another solution is to give corporate directors minimum terms of five years.

RELATED ARTICLE

"Societal Influence Model for the Newspaper Industry"Inspired first by Boyle, then by Mitchell, my students and I have been looking for ways to measure journalism quality and relate it to long-term profitability. Most of those who know Wall Street tell us it’s a fool’s errand, that nothing can change its culture of greed and corruption. But why can’t quality-minded journalists turn the greed to our advantage? Mitchell gives us hope by making it clear that investors and their analysts are not stupid. A company’s value is based on its current earnings plus the discounted present value of its future earnings. An investor who is given a way to predict earnings further out than the quarterly trend is able to show will have an advantage.

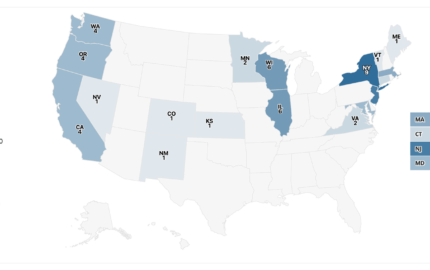

Here’s one example. We looked at a small sample of newspapers where we have survey data showing how much they are trusted. Those with the highest level of trust had the most success in resisting the nationwide decline in home-county circulation penetration from 1995 to 2000.

This approach—finding more rational numbers for Wall Street to look at—holds more promise than the usual exhortations against greed. Asking the greedy investors to retire from the scene and allow themselves to be replaced by more public-spirited decision-makers might have some psychological value for us, but it doesn’t lead anywhere.

The way to fight the irrational use of numbers is to follow Boyle’s lead and go after some better numbers.

Philip Meyer, a 1967 Nieman Fellow, is a professor of and Knight Chair in Journalism at the University of North Carolina at Chapel Hill.