In the media maelstrom that followed Jay Harris’s resignation as publisher of the San Jose Mercury News, writers and critics most often have framed the issue behind his leaving as a battle between profit and journalism. They have expressed a concern that resources flowing to stockholders come from the newsrooms and reduce the quality of journalism. Though this is a legitimate way to define the debate, it concentrates attention on corporate managers’ decisions and downplays the impact of four important trends that are currently reshaping the newspaper industry.

These four trends—two within the newspaper industry and two outside of it—involve increased public ownership of newspapers, a decline in competition among newspapers, greater diversification in society, and the growth of electronic media. Let’s briefly examine each.

Industries constantly face change, but the current newspaper situation is unusual because the two industry trends are pushing newspapers toward higher profit margins, but the two society trends are working in the opposite direction. At this point, it seems likely that the two social trends will overpower the industry trends.

In such a time of fundamental market and societal change, the critical issue concerns whether the desire for short-term profits will force some current companies out of the newspaper business. The demand of institutional investors and stock analysts for consistent, high profit margins is well documented. Newspapers initially were able to meet these profit demands because of increasing technological efficiency and declining competition among newspapers. With declining competition, newsholes and newsrooms shrank and newspapers became more aggressive in hiking advertising prices. Declining cost and savings from technology offset losses of circulation and the decline in the percentage of all advertising dollars spent on newspaper advertising.

But the ability to cut costs and increase revenue will decline as the impact of the social trends accelerates. If newspapers expect to attract advertising dollars in increasingly fragmented and competitive markets, they must maintain their circulation relative to the audience of other media outlets. In a diverse society, this requires larger newsholes, as well as larger and more representative newsrooms. People seeking more narrowly focused news and information will find little of interest to them if newspapers cut space to save money. The loss of readers will limit the ability of newspaper managers to be aggressive in advertising pricing. Businesses already have expressed a reluctance to pay these aggressive ad prices as circulation declines. This reluctance will only increase.

Newspaper corporations face a choice. They can try to reduce profit expectations to reflect the changing nature of society. Or they can maintain short-run profit margins at the risk of losing their readers and permanently damaging the value of their companies. Thomson chose the latter for its U.S. newspapers and ended up selling them when management could not raise profit margins above 17 percent. The profit margin declined to 17 percent in the early 1990’s after more than a decade of 30 percent or higher margins. Thomson paid for its aggressive cost cutting to maintain high margins with a significant decline in circulation and penetration during the 1980’s.

Neither of these choices will be easy, and it is impossible to predict accurately when a newspaper company has cut so deep into its newsroom that it permanently damages its franchise. However, research and experience support three propositions:

In the long run, newspapers will not be able to sustain the current level of profit margins. One economic rule remains clear across time and will affect newspapers—as intermedia competition for advertising dollars increases, newspaper profits will decline. The markets, driven by the two social trends discussed above, will force smaller margins on newspaper companies. The question will be whether management invests enough in the newsroom, and does so in constructive and strategic ways, to maintain a profit that will sustain the newspaper across time, or whether high short-run profits result in the company being forced out of the newspaper business.

A strong point of the market system is that demand will be served. The public wants journalism that meets its information needs and desires. In the long run, companies will meet that demand or they will falter. At issue is which of today’s newspaper companies will continue to meet those needs 30 or 40 years from now.

Stephen Lacy is a professor in the Michigan State University School of Journalism, where he teaches media management and economics. He has cowritten or coedited four books and more than 75 scholarly articles and papers about media economics and management. He worked at weekly and daily newspapers before becoming a professor.

These four trends—two within the newspaper industry and two outside of it—involve increased public ownership of newspapers, a decline in competition among newspapers, greater diversification in society, and the growth of electronic media. Let’s briefly examine each.

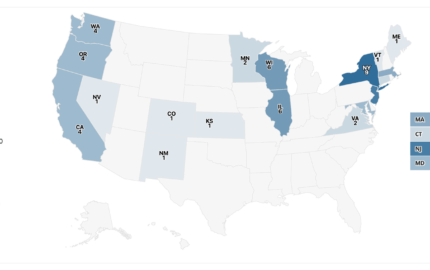

- Public ownership: Led by Gannett during the 1960’s, most large newspaper corporations now trade their stock publicly. This has moved control over a corporation’s goals from a relatively few family members to managers of large institutional investment funds and to stock analysts who advise investors. As a result, publicly held newspaper corporations must produce consistent, high profit margins. If expectations are not met, stock value declines.

- Decline of newspaper competition: Because of economic factors, competition between dailies in the same town or city has practically disappeared, and competition across city and county lines is declining because of clustering. While this provides more profit for companies, it reduces the perceived need to invest in the newsroom and diminishes competition among individual journalists who thrive on it.

- Diversification of society: During the last half of the 20th century dramatic changes occurred in U.S. women’s lives. Career options and lifestyles choices are much greater for them today. In addition to increased gender diversity in the workplace, a higher birth rate for minority groups and immigration have created more racial diversification. By midway through the 21st century, no racial group will be a clear majority of the U.S. population. This diversification leads readers to demand that newspapers offer a greater variety of news and information, something more difficult and expensive to do than when those needs emanated from a relatively homogeneous community. Increased coverage of a particular group of readers requires either more space to be added to the newspaper or space to be taken from the interests of other groups. The former is expensive; the latter tends to lead to lower circulation.

- Growth of electronic media: People have more ways of getting information now than at any time in history. The boom in cable and the Internet gives individuals the ability to focus on narrow topics of interest and avoid spending time sifting through more generalized news presentations, thus fragmenting the audience. Shrinking audiences and circulations cause businesses to buy advertising from a larger number of media outlets to reach the numbers of people they want as customers. Newspapers increasingly must compete with other media for the advertising dollar. And this intermedia competition comes at a time when newspaper managers felt they were gaining more market power because of declining newspaper competition. Understanding the nature of and responding to intermedia advertising competition remains difficult for newspaper managers.

Industries constantly face change, but the current newspaper situation is unusual because the two industry trends are pushing newspapers toward higher profit margins, but the two society trends are working in the opposite direction. At this point, it seems likely that the two social trends will overpower the industry trends.

In such a time of fundamental market and societal change, the critical issue concerns whether the desire for short-term profits will force some current companies out of the newspaper business. The demand of institutional investors and stock analysts for consistent, high profit margins is well documented. Newspapers initially were able to meet these profit demands because of increasing technological efficiency and declining competition among newspapers. With declining competition, newsholes and newsrooms shrank and newspapers became more aggressive in hiking advertising prices. Declining cost and savings from technology offset losses of circulation and the decline in the percentage of all advertising dollars spent on newspaper advertising.

But the ability to cut costs and increase revenue will decline as the impact of the social trends accelerates. If newspapers expect to attract advertising dollars in increasingly fragmented and competitive markets, they must maintain their circulation relative to the audience of other media outlets. In a diverse society, this requires larger newsholes, as well as larger and more representative newsrooms. People seeking more narrowly focused news and information will find little of interest to them if newspapers cut space to save money. The loss of readers will limit the ability of newspaper managers to be aggressive in advertising pricing. Businesses already have expressed a reluctance to pay these aggressive ad prices as circulation declines. This reluctance will only increase.

Newspaper corporations face a choice. They can try to reduce profit expectations to reflect the changing nature of society. Or they can maintain short-run profit margins at the risk of losing their readers and permanently damaging the value of their companies. Thomson chose the latter for its U.S. newspapers and ended up selling them when management could not raise profit margins above 17 percent. The profit margin declined to 17 percent in the early 1990’s after more than a decade of 30 percent or higher margins. Thomson paid for its aggressive cost cutting to maintain high margins with a significant decline in circulation and penetration during the 1980’s.

Neither of these choices will be easy, and it is impossible to predict accurately when a newspaper company has cut so deep into its newsroom that it permanently damages its franchise. However, research and experience support three propositions:

- First, the smaller the newspaper market, the more quickly permanent circulation damage will occur from cost cutting. Losing 2,000 circulation from a base of 14,000 will have a greater impact than losing 2,000 from a base of 100,000.

- Second, the higher the profit expectation, the greater will be the negative impact on the quality of the newspaper over time. It is true that monetary investment in a newsroom does not necessarily result in a proportionate increase in quality. Newsrooms have waste and diminishing returns on investment after a point. But even if the outcome is not proportionate, research supports that investment in content that meets the needs and wants of its community will increase circulation, all else being equal.

- Third, no one really knows how much newsroom investment is needed to maintain and/or expand circulation. If we did, it would be easier to make a case to investors for some balance in the distribution of profit between making such investments and returning money to ownership. It is this uncertainty that allows Wall Street to press for the high margins it demands.

In the long run, newspapers will not be able to sustain the current level of profit margins. One economic rule remains clear across time and will affect newspapers—as intermedia competition for advertising dollars increases, newspaper profits will decline. The markets, driven by the two social trends discussed above, will force smaller margins on newspaper companies. The question will be whether management invests enough in the newsroom, and does so in constructive and strategic ways, to maintain a profit that will sustain the newspaper across time, or whether high short-run profits result in the company being forced out of the newspaper business.

A strong point of the market system is that demand will be served. The public wants journalism that meets its information needs and desires. In the long run, companies will meet that demand or they will falter. At issue is which of today’s newspaper companies will continue to meet those needs 30 or 40 years from now.

Stephen Lacy is a professor in the Michigan State University School of Journalism, where he teaches media management and economics. He has cowritten or coedited four books and more than 75 scholarly articles and papers about media economics and management. He worked at weekly and daily newspapers before becoming a professor.