“…In the early ’90’s, Enron made money with, for example, an oil partnership dubbed Jedi, after the “Star Wars” knights. One of its many subsidiaries, Raptor, which invested in Internet firms, was virtually minting money as its portfolio soared. And when Enron made a deal with Blockbuster Video to deliver movies on demand over the fiber optic cables it was installing across the country, Enron seemed to be making all the right connections.…” Paul Solman’s words and video stills courtesy of “The NewsHour with Jim Lehrer,” MacNeil/Lehrer Productions.

Ah, Enron. I feel I owe the company a thank you. For a journalist who makes his living by explanation rather than scoops, spot news, or investigative reporting, the various pieces of the Enron story were like so many fish in a barrel: easy to isolate and smelly enough to demand explanation. After years of O.J. Simpson and oral sex on the one hand, Palestinians and Afghanis on the other, the top story was finally on my beat, and few people understood the mechanics behind it. In short, an ideal opportunity.

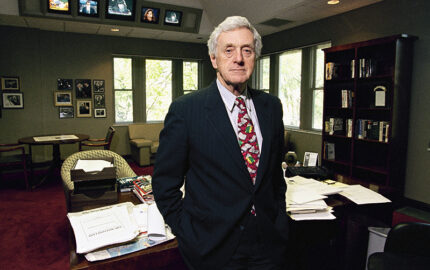

A bit of background, for the many of you who don’t know my work. For the past 25 years or so, I’ve worked for public television (since 1985, I’ve been the economics correspondent for what’s now called “The NewsHour with Jim Lehrer”). In hundreds of 10- to 14-minute videotaped segments, I and one of several producers (most frequently Lee Koromvokis and before that Lori Cohen) have tried to explain various aspects of business and economics using topical stories as illustrations. The ultimate goal: to demystify issues that many viewers consider “beyond them,” “too complicated,” “esoteric.” Since the audience tends to think business and economics are “boring” as well, we’ve tried to amuse whenever possible, if only to keep folks awake.

Given our mission—and the obstacles to achieving it—Enron’s collapse was, for us, a godsend. The story was getting so much attention that viewers would be interested in spite of themselves. Moreover, Enron had reached that critical mass at which point a story feeds on itself, with Congressional committees certain to extend the time frame. In other words, we didn’t have to worry that the story would fade before we finished our piece(s) on it. (It can take weeks to put together a feature for television.) And our audience members would need no cajoling: They really wanted to understand—for the first time in recent memory—about arcana like auditing and annual reports.

There was at least one other advantage to the Enron story: The corporate behavior seemed so extreme—outlandish, even—that we could have fun with it. Covering most tales of apparent corporate malfeasance, the reporter/producer team has to tread with trepidation, if not actually pussyfoot around, both because of the time-honored need for even-handedness (especially on a program such as ours) and the threat of expensive legal action, however frivolous the grounds. But Enron’s over-the-top behavior and subsequent plunge emboldened those covering it: The accounting antics, once they had been explained, provided amazing testimony for the prosecution. Explaining them with a certain irreverence seemed, well, not inappropriate. In fact, it was our eponym himself, Jim Lehrer, who suggested we use games or toys (devices we’d employed years ago in other contexts) to explain Enron.

Our story on Enron’s fall aspired to be not so much a whodunit as a howtheydunit. What, for example, were the so-called “special purpose entities”—partnerships that seemed part of the company, yet for accounting purposes hadn’t been? How did Enron’s “swaps” work? How could a company seem so profitable and yet go broke so quickly?

The challenge was to explain all this on TV, comprehensibly and engagingly. That meant coming up with a narrative device that would both convey what Enron had done in general and allow us to explain the particulars. Partly, we needed such a device because candid interviews would be scarce: The usual suspects—in this case, Enron’s top brass—weren’t even talking when they were subpoenaed by Congress. How likely were they to talk to us? Moreover, years of experience suggested that those experts who would talk—and be willing to explain the intricacies of corporate finance to a TV audience—might be less than compelling, clear or succinct.

And even if they were good talkers, why not just bring them into the studio to be interviewed live? A video piece, by contrast, usually works best as a sort of field trip: an excursion to a visually interesting or otherwise exotic locale—which Columbia Law School, say, or the Baruch College accounting department, is not. Without intriguing interviews or location, the fallback would be to rely on explanation, tightly written and rewritten, carefully edited. But for a video piece, we needed something more than a script relentlessly read to the camera. We needed to create a setting, an environment, a device.

So we tried gimmick after gimmick: a Monopoly board (since Enron was trying to corner the market); a Dungeons & Dragons-like game of our own devising (since the whole affair had a teenage-boy fantasy feel to it); some sort of “Star Wars” spinoff (since “Star Wars” characters featured in Enron’s schemes). But producer Mary Jo Brooks and I finally decided we’d be better off with a broader metaphor, one that would give us more room to maneuver than a game.

What was the essence of the Enron end run, we asked ourselves? What was the real point of its financial finagling? The effort to turn losses into profits, we decided, dross into gold. At which point, a metaphor materialized: a magic act. Upon further reflection, we narrowed the metaphor further: “accounting alchemy.”

Thus, our narrative device: Enron had, in effect, been practicing financial sleight of hand, something we could simulate through the magic of television. (It even provided us with a pun: sleight of hand is “legerdemain” derived from old French; “ledger-demain” in Enron’s case, I said in the final piece, as a ledger book went poof). I could now deliver an explanatory script straight to camera, making reference to magic and using toys as props (the “Star Wars” characters in particular), which could appear and vanish—with the wave of a wand.

But this raised a different concern: too much of me at a stretch, fiddling with toys. (To keep viewers’ attention, it helps to keep them off guard, often by changing settings from time to time. A single device can quickly wear out the audience’s welcome. A single presenter with a propulsive style like mine can simply wear the audience out.)

One solution we’d used in past “explainers” was a confederate—an expert of some sort—whose purpose was to echo or amplify points we were making. We had one here, too: an accounting professor from New York, Douglas Carmichael. But, unfortunately, we interviewed him before we arrived at our metaphor, so his usefulness was limited. For this piece, he could help establish Enron the Underhanded, but not help explain what, when interviewing him, we didn’t know how to ask. We were on too tight a deadline and budget to do another interview.

Also, since we were explaining pretty fancy financial ploys (ones that had kept investors themselves in the dark for years), it would be good to remember a favorite mantra: “Repetition is the soul of understanding.” What supplementary device might we use, then, both to shift gears and to reiterate the specifics of Enron’s trickery in order to make it clear and (in the best of all possible outcomes) memorable?

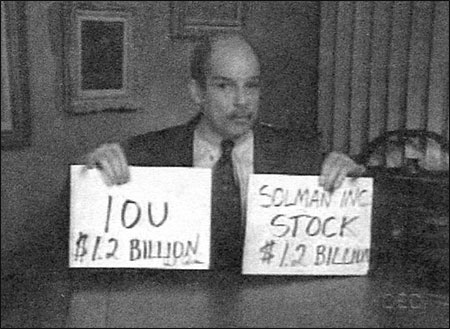

We decided to rely on analogy. And since we were actually shooting at the New York City apartment in which I grew up, we thought of family photos as a second gimmick, as in: “Suppose I started a firm with my father, called it Solman and Solman [hold up photo of dad and me here], invested the money of a few NewsHour viewers….” So I broke away from the alchemy device (twice) to use family photographs—repeating the essence of Enron’s accounting tricks in a different, more familiar context.

You can judge the effectiveness of these efforts by going to pbs.org/ newshour, where, last I knew, a video version of “accounting alchemy” is available for download. (It ran live on January 22.) And subsequent Enron explainers—on the private sector watchdogs, government oversight, 401(k) pension plans and derivatives—are also up at that address. (In the spirit of the above account, the derivatives story featured Ken and Barbie.)

A last word. Every one of these scripts was extensively edited and rewritten. That is our usual way of doing it, but in the case of explainers, it is especially important. If you’re going to use tomfoolery, you’d better know what you’re talking about. And make sure your audience will, too. I sometimes send drafts, even read scripts aloud, to professor friends and colleagues alike, looking for mistakes, obscurities, sources of confusion. It can be a pain. But I’ve learned, over the years, that if someone tells me, “I just wasn’t smart enough to follow you,” that really means I wasn’t smart enough to lead.

“…Back in the family, this is like pretending to sell $1.2 billion worth of my own company’s stock to myself, giving myself my own I.O.U. for $1.2 billion in return, then recording the sale as if it were for cash. The SEC was literally established to prevent such abuses.…” Paul Solman’s words and video still courtesy of “The NewsHour with Jim Lehrer,” MacNeil/Lehrer Productions.

Paul Solman, a 1977 Nieman Fellow, is economics correspondent for “The NewsHour with Jim Lehrer.”