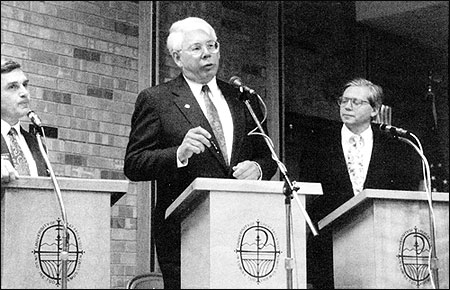

Democratic candidate Bill Yellowtail presented his views as Republican Rick Hill, left, and Natural Law Party candidate Jim Brooks, right, waited their turn in a debate in Great Falls, Montana, about a month before the 1996 Congressional election. Great Falls Tribune Photo by Stuart S. White.

RELATED ARTICLES

"A Dozen Tips for Stories About Nonprofits"

- George Rodrigue

"Types of Nonprofits"In the fall of 1996, Republican candidate Rick Hill had a problem. His opponent for Montana's only U.S. House seat, Democrat Bill Yellowtail, was ahead in the polls. Hill knew he could cripple Yellowtail by running ads resurrecting old charges of wife-beating. But if Hill slung the mud, he'd get his own hands dirty. And he had just promised to fight clean.

Fortunately for him, someone else took up the cudgel. "Who is Bill Yellowtail?" television commercials asked repeatedly. "He preaches family values, but he took a swing at his wife...."

Yellowtail's campaign deflated. Hill's hands looked clean. The ads weren't bought by his campaign, or by the Republican Party. A nonprofit group, "Citizens for Reform," paid for them. No one could say what it was. Only after the election would investigators find a document indicating that the Hill campaign had asked it to attack Yellowtail.

That was just a trickle in the secret river of money that Republican groups channeled through nonprofits. One group alone, Americans for Tax Reform, got at least $4.3 million from the GOP. Democrats were outgunned, but not for lack of effort. They funneled $3 million through another nonprofit, Vote Now '96. Its mission was to boost voter turnout, especially among voters who happened to be Democrats.

Meanwhile, Republican Presidential nominee Bob Dole pushed an unusual idea for helping the poor: Government would step back and let local charities provide welfare benefits. Newspapers took little note of his plan, or of the nonprofit leaders who called it a threat to their needy clients.

Failure to monitor nonprofits in one case. Failure to explain their problems, or protect vulnerable citizens, in the other. Unfortunately, many experts say that's typical news coverage of nonprofits.

"The sector is poorly understood and is even more poorly under-covered by mainstream publications. We see an occasional investigative piece and an occasional feel-good piece and nothing much in between," said Charles Shepard, formerly a reporter at The Washington Post.

Shepard spoke at a seminar in 1993, after reporting on how the president of the United Way of America used charity funds to please his teenaged mistress. But many journalists say the problem remains today.

Media watchers in the nonprofit community agree. "The watchdog seldom barks," said Elizabeth Boris, director of the Urban Institute's Center on Nonprofits and Philanthropy. "The media have not done a very good job of keeping the nonprofits accountable," agreed Robert O. Bothwell, President of the National Committee for Responsive Philanthropy. "But then, neither has anyone else."

More's the pity, because good coverage grows more important by the day, said Todd Cohen, who left The Raleigh News & Observer to found The Philanthropy Journal of North Carolina.

As the federal government retreats and businesses grow more profit-centered, Cohen said, a social gap is widening. Historically, nonprofits filled that gap, supporting everything from the early poorhouses to women's suffrage and the civil rights movement. With problems now increasingly localized, Cohen said, local charities offer reporters a window on key problems facing their communities: "poverty, racism, intolerance, poor health, illiteracy, the state of natural resources and the state of human relationships."

But, he added, "the toughest thing for the media to cover is the process of change. It's a lot easier to cover a shooting or a train wreck or a scandal."

Big Money

Even people who care nothing for the poor may care deeply about nonprofits, because they are a huge and fast-growing part of the economy. Federal tax exemptions alone cost more than $21 billion in 1997, according to the U.S. Internal Revenue Service. A tally by The Philadelphia Inquirer, including local property-tax exemptions, put the total tax expense at more than $36.5 billion annually. The paper estimated total nonprofit revenues at $500 billion annually. Paid and volunteer staffs account for perhaps one out of ten working Americans. The IRS has already granted tax exemptions to some 1.1 million organizations. Over the past decade, about 75 new groups have won tax exemptions daily. Since 1970, the sector has grown at four times the rate of the overall U.S. economy.

The sector is as diverse as it is huge, and not always profitless or charitable. Only about half of all nonprofits are churches or charities, and only about 10 cents of every donated dollar goes to the poor. The Little Sisters of the Poor are tax-exempt. So is Harvard University, whose $7 billion endowment dwarfs some third-world economies. Your local little league is a nonprofit. So is the National Hockey League. Some hospitals are nonprofits, but they behave very much like the profit-making institutions with which they compete—to the dismay of some private business owners. Even defense contractors can be nonprofits. Witness Mitre Corp., which helped develop the AWACS aircraft and earned $572 million in 1991.

Tax law creates several types of exempt organizations. Generally, only charities, churches and schools qualifying under section 501(c)(3) of the tax code can offer donors the chance to deduct gifts from their taxable income. Other nonprofits, however, can claim exemptions from income taxes, and often from local taxes as well. Those exemptions can be a major cost to local government.

Basic Watchdog Duties

Despite their diversity, nonprofits have much in common. They must promise to serve a public purpose when they file their IRS Form 1023 or 1024 to get tax-exempt status. They must promise that staff and directors—who do pay income taxes—will not benefit unduly from their tax-exempt status.

The most basic duty of journalism's watchdogs may be to ensure that they keep those promises.

Newspaper morgues are littered with the carcasses of people caught breaking that public trust. United Way of America chief executive William Aramony drew a seven-year prison term in 1995 for misuse of charity funds. PTL minister Jim Bakker became notorious for cheating on his wife with a church secretary. He drew a 45-year prison term in 1989, after revelations that he used church funds to bless himself with a fleet of Mercedes and Rolls-Royce autos. He also bought an air-conditioned doghouse.

The Aramony and Bakker convictions, however, may serve less as proof of journalistic vigilance than as indices of widespread negligence.

Bakker founded his ministry in 1974, and stayed in the religion business long enough to bilk his followers of $158 million.

Aramony spent the years before his conviction ostentatiously living the high life at the charity's expense. He spent $40,762 on tickets for himself and his companions (including his teenaged mistress) to fly the Concorde supersonic transport between 1987and 1990. His limousine bill for 1991 was $20,000. His romantic misuse of charity resources was well known within the office. "He would meet somebody on an airplane, and she would be on the payroll the next day," said George Wilkins, a former vice president with the charity. "You would question him, and you're told basically that was none of your damn business." But, insiders said, he was a terrific fundraiser, so the United Way's 37-member board ignored his misdeeds. Its tolerance was so noteworthy that Aramony's lawyer argued at trial that the board had approved his behavior.

To many analysts of the nonprofit sector, the cases that make headlines appear to be just a small part of the problem. In 1993, the IRS reviewed several dozen television ministries for Congress. It found 18 in trouble, mostly for excessive payments to ministers and their families or for impermissible political activity.

"Some charities exist more for the benefit of officers and fundraisers than the public," a congressional committee said in 1994. Connecticut's attorney general reported "a steady growth in the number of people and organizations that are willing to abuse the generosity of the public and flout federal and state laws." The Genie Project, set up to grant the last wishes of dying children, spent only 4 percent of its revenues for that purpose. A brain-tumor research organization raised $500,000. On research, it spent $5,000.

Weak Internal Oversight

The structure of nonprofits partly explains the problem of misuse of funds. They lack many of the checks and balances built into private businesses. Donors are giving to the agencies, not buying from them. They have no reason to demand value for their money, as a business customer would. They have no incentive to protect their investment, as a stockholder would. Auditors, likewise, have no list of invoices to compare with bank deposits. And cash-strapped nonprofit groups may feel they cannot afford the large office staffs that provide some built-in security for government and business organizations. At many nonprofits, the same staff person might receive a check, log it in and deposit it in the bank.

Many nonprofits also share a sense of mission that causes insiders to overlook misdeeds, or to circle the wagons to protect a cause in which they deeply believe.

Long before newspaper reports that he may have diverted more than $1 million in National Baptist Convention USA funds to a secret bank account in Wisconsin, friends had doubts about convention President Henry J. Lyons. But despite "years of repeated whispers about a troubled marriage and money grubbing," St. Petersburg Times columnist Elijah Gosier wrote, no one blew the whistle—until Lyons's wife, Deborah, found a deed at their home indicating that he had bought a $700,000 house with another woman. Mrs. Lyons was arrested for setting fire to the home. Then the public learned that Lyons had bought it along with a convicted embezzler and church employee named Bernice Edwards. He'd also used church funds to buy her a diamond ring and property at Lake Tahoe. He called those business transactions, undertaken to help a friend. Meanwhile, he admitted keeping more than $200,000 in donations meant for burned-out black churches. Even so, colleagues rallied behind him. They voted to retain him in September, 1997, after he begged their forgiveness.

The need for journalistic over-sight is all the greater because the Internal Revenue Service, the only nationwide regulator of nonprofits, is overwhelmed. "There are 1.1 million tax-exempt organizations and another 340,000 churches, and there are about 635 revenue agents who enforce this area of the law," said Jim McGovern, former chief of the tax service's exempt-organizations section. "That's an enormous number of tax-exempt organizations and extremely few resources.... So the role the media plays is of increasing significance."

In 1996, the IRS approved 48,635 applications and denied 577. Once approved, a group could expect to go 50 to 100 years, statistically speaking, without an IRS audit. Churches are not required to file tax returns. Of the 563,710 returns that were filed in 1996, the IRS examined only 11,020.

Audit rates have plunged since the 1970's, as Congress froze the size of the IRS's nonprofit auditing staff while the number of nonprofits doubled. The IRS could audit one out of 36 nonprofit returns in 1980. By 1993, it was down to one out of 100.

Congress's General Accounting office found in 1995 that the IRS was not able to enforce rules banning undue pay and benefits for nonprofits' officers and directors. Of 673 executive pay packages reviewed, 100 earned more than $200,000. Many executives also profited from for-profit firms that were related to their nonprofit employer. GAO found that of 285 groups it reviewed, 29 percent of the top executives earned more than $10,000 from related groups. Such pay ranged up to $711,000.

The general lack of oversight troubled even leading nonprofits. In the early 1990's, they asked Congress to provide more controls, lest bad charities effectively drive out the good ones— or dissuade people from supporting them. "It's obvious that the IRS does not have a big enough staff in terms of oversight of nonprofit groups and our organization believes that they should," said John Thomas, Vice President of Independent Sector, which exists to protect and promote the sector. "Ethics and disclosure and accountability are all things that we promote among our members." Without adequate policing, he added, bad charities could drive out good ones; public faith in the whole sector could evaporate.

Nonprofits fought harder for effective disclosure requirements than did the news media, according to Stacy Palmer, managing editor of The Chronicle of Philanthropy. "As a profession, we need to push for more openness," she said. "These organization are tax-exempt. We have a direct stake in what they do."

New Tools

Over the past few years. Congress has beefed up the IRS somewhat and allowed it to fine organizations and executives that break the rules. Those fines must be listed on Form 990 tax returns, giving reporters a new and potentially revealing indicator of misdeeds.

Congress also has toughened disclosure requirements on nonprofits. In the past, they were required to let the public view their tax returns, but only at their headquarters and only during office hours. In the future they will be required to mail copies of the tax documents to anyone who requests them and to charge a reasonable rate for the service.

The National Committee for Responsive Philanthropy calk that a badly needed improvement. In 1995, it set out to get Form 990's for 174 corporate nonprofit foundations. It took two years and cost ?35,541. Only 47 foundations cooperated fully. Ten refused to provide any information; 76 ignored all requests. The IRS wasn't much better. Initially, its clerks could provide only 18 returns. On average, it took the IRS five months to comply. Of the tax returns the committee got, 59 omitted basic information such as the name and pay of nonprofit board members.

Business Watchdogs

Many people in the nonprofit community hope journalists will use their new tools to go beyond the simple search for scandal. From their point of view, the crucial stories concern questions not of graft but of mission: What social purposes are nonprofits performing, in return for their tax exemptions? What problems do they face in achieving those goals? That will require reporters covering nonprofits to think like business writers.

While the news media focused on William Aramony's misuse of United Way funds, for instance, America's nonprofit hospitals and Health Maintenance Organizations were going through a quiet revolution. With their profits squeezed by government policies and market forces, all were changing the way they did business. Many were selling out to for-profit chains. Surveying sales ;is of 1997, one expert said some sales may have been motivated by greed, not need. Executives and board members sometimes benefited from stock options and deferred compensation, Lawrence E. Singer found. Some also got large pay raises from the for-profit firms they'd helped take over. Negotiating (unsuccessfully) to buy Ohio's Blue Cross-Blue Shield state plan, Columbia/HCA offered to let the nonprofit's top executives split a $16 million consulting fee.

Public attention can powerfully affect such deals. Leaders of California's Blue Cross-Blue Shield sought to quietly convert it to a for-profit enterprise. The IRS regards such conversions as a sale, in effect, and requires purchasers to pay a fair price, with proceeds put into new or existing charitable foundations. The first offer for California's Blue Cross was $100 million. After a public outcry, the price rose to $3.3 billion. The public's return on years of nonprofit tax exemptions had grown by 3,300 percent.

Such scrutiny was not common enough, however, said John Griffith, a health policy professor at the University of Michigan. "There was a lot of stealth," he said. Indeed, sometimes even the board members who were asked to approve the deals were kept in the dark about them. Trustees of an Ohio hospital were dismissed after they objected to being asked to ratify a sale "without telling us who it was with and what it was," said Robert Rownd, one of the trustees. "We never knew the amount of money involved."

Follow-up Needed

Even when newspapers focus on a sale, they don't always watch the aftermath. "In a whole range of cases the transaction took place for a set amount of money...and then the whole thing was sold again within a year to another organization for a gigantic profit," said Bradford Gray, Director of the New York Academy of Medicine's division of health and science policy.

That is not to say that conversions to for-profit status are invariably bad. Buyouts can be necessary to keep institutions alive. Nonprofits are not always paragons of good management, or avid practitioners of charity.

Cape Coral Hospital in Florida was sold after directors suddenly discovered that it was losing $1 million a month. For years, those directors had ignored signs of trouble. Their curiosity was not aroused by high-living executives who resisted financial disclosure requests. Nor did they notice that the hospital repeatedly issued bonds for the same item. They demanded that executives boil down financial reports from 30 pages to 1, because they found the longer document too confusing.

Fiscal pressures finally forced executives to propose a sale. Only then. The Wall Street Journal reported, did the board learn that top executives allegedly had siphoned $1.1 million out of secret accounts, created ghost employees and used their paychecks to buy cocaine, and even stolen the silver recovered from used X-ray film. Some board members also benefited from hospital funds; Cape Coral invested in improvements to the directors' commercial property.

"Exploiting charitable assets for personal gain isn't extraordinary in the inbred world of nonprofit hospitals," IRS official Marcus Owens told The Journal. "The tremendous financial resources available in a nonprofit hospital, combined with a board of directors with local businesspeople and doctors, make it ripe for insider transactions and business deals." As for charitable care, Methodist

Hospital in Houston, Texas, preserved its nonprofit status despite policies that required all uninsured patients (save for emergency cases) to pay a pre-admission deposit equal to the full costs of care. Many other "charity" hospitals provide only a few percentage points of their revenue to non-paying customers. The Harvard Business Review surveyed nonprofit hospitals and reported in 1997 that they did not serve their communities better than for-profits. Rather, The Review found, hospitals used the benefits of tax exemptions to enrich affiliated doctors, "who are their main customers."

On the other hand, the consumer group Families USA recently reported that nonprofit HMO's tended to provide the most desirable care to Medicare recipients, while for-profit HMO's provided most of the least desirable care. The California Medical Association found that nonprofits generally devoted a higher share of their income to medical care than did for-profit HMO's. And there is some evidence that frail elderly people in nonprofit, faith-based nursing homes are less likely to be drugged into a stupor than those in for-profit homes.

"I don't think that this should be approached as a good guy, bad guy thing. Which is how too many of these public policy stories are approached," said Northwestern University economist Burton Weisbrod. Rather, he said, every nonprofit institution and every business deal must be evaluated on its merits. And reporters should not stop looking after the first deal is done. Watch what becomes of the charitable foundations that hold the proceeds. Some take a broad definition of charity. They fund sports events, art shows and flight schools.

Political Watchdogs

Political reporters also need to serve as nonprofit watchdogs.

Until the 1996 election, the major recent test may have been charting the rise of the Christian Right. Newspapers have earned high marks for tracking that development, according to American University political scientist Mark J. Rozell, who has 'written several books and articles on the subject.

In general, he said, the media have failed to describe the motives or methods of religious conservatives,who have seized control of Republican Party machinery in countless localities and many states. Because of that, he said, opponents think of the Christian Right in terms of stereotypes. And churches, absent meaningful oversight, have allowed themselves to be used as political platforms, in direct contravention of federal law.

Americans United for Separation of Church and State says some liberal ministers continue to issue endorsements from the pulpit. Conservatives do likewise. And while Pat Robertson vows to elect a Republican President in 2000, his Christian Coalition produces hundreds of thousands of "voter guides" for distribution in conservative churches. Impartial scholars say the guides are blatantly biased toward Republican candidates. The Church at Pierce Creek in Binghamton, N.Y., took out full-page advertisements in USA Today and The Washington Post during the 1992 election likening Bill Clinton to the devil himself. Clinton "is promoting policies that are in rebellion to God's laws," the churches said. "How then can we vote for Bill Clinton?"

"There are activities within the movement that are very questionable within the law and are not being reported carefully, and I'm not sure why," said Rozell.

During the 1996 elections, Associated Press writer Jim Drinkard was one of relatively few political reporters to glimpse a new problem. In late October, his colleagues reported that previously unknown nonprofits were pouring hundreds of thousands of dollars into ads attacking Democratic candidates. Drinkard heard of the phenomenon in only a handful of cases, but wanted to find out more. He called one of the men who seemed to be in the middle of things: former Reagan administration political operative Lyn Nofeiger.

"Lyn was, 'Aw, shucks, we're just trying to do some work out there,'" Drinkard recalled. "I think that it was clear to them that all they had to do was keep it a mystery for another week and they'd be home free. Which they were... I feel a little bit like we were asleep at the wheel."

The group Nofziger was associated with, TRIAD Management Services Inc., was using at least two nonprofit groups to run ads in more than two dozen congressional campaigns. In Montana, Citizens for Reform was labeling Yellowtail a wife-beater. In California, it was accusing Democratic House candidate Calvin M. Dooley of being soft on the death penalty. He could only respond that he had voted for it 28 of 29 times. Another TRIAD-affiliated nonprofit, Citizens for the Republic Education Fund, spent about $3 million to air TV commercials across the country. Carolyn Malenick, a former fundraiser for Oliver North, who ran TRIAD, denied any illegalities or improprieties. She and her colleagues described their ads as "issue-oriented," and therefore exempt from Federal Election Commission disclosure requirements. Grover Norquist, whose Americans for Tax Reform nonprofit got $43 million from the GOP for a pre-election ad campaign concerning Medicare, said likewise.

Federal law imposes virtually no limits on nonprofits that run issue ads. Ad buys need not be disclosed to opposing campaigns. The names of donors can remain secret. "The clear advantage that you get from being a nonprofit is secrecy. Stealth," said Drinkard. For the Republican leadership, nonprofits offered another advantage. Federal law normally places an indirect limit on parties' use of money from big donors, by forcing them to match such spending with money donated by smaller givers. Republican Party Chairman Haley Harbour told reporters just before the 1996 election that the GOP had received so many big donations from corporations and wealthy individuals that it could not match them with smaller donors' money. So, he said, the Republican National Committee chose to give the money to "several groups who are like-minded."

Yet federal law bans "coordination" between groups that buy ads and the campaigns they benefit. Republicans have long accused the Democrats of coordinating activities with nonprofit labor unions, for example. They made similar charges against Vote Now '96, a get-out-the-vote nonprofit. And they did produce evidence that leading Democrats steered big donors to the nonprofit, confident that the voters it would get out would be Democrats.

The Republican majority ended Senate hearings before Democrats were permitted to dissect the GOP's relationships with friendly nonprofits. Democratic investigators with the Senate Government Oversight Committee say that had hearings continued, they'd have produced ample evidence of coordination. One TRIAD memo given to Time recounted a TRIAD operative's visit to the Hill campaign in Montana. It said the campaign needed a "third party to expose Yellowtail wife-beating."

Senate investigators cannot prove it, but they think that 90 percent of Triad's $ 1.3 million war chest came from Charles and David Koch, two billionaire oil men with a fervently anti-tax, anti-regulation agenda. The few other known donors to TRIAD have described themselves as extremely successful business owners and extremely conservative.

But Senate investigators said they know of no journalists who accurately described the nonprofits' efforts before the election. Even when reporters looked, they could learn precious little. Nonprofits' expenses must be listed on their Form 990s, but the tax returns are not due until months after an election. Nonprofits need almost never disclose their donors.

Mark Braden, a TRIAD lawyer, said that is as it should be. Privacy is a legitimate concern for donors, he said. Drinkard, however, sees a danger to the entire political system. "It's a very insidious thing when people can inject themselves into politics anonymously," he said. "Normally when you get up to talk or debate, people know who you are. And that seems fair to me. If you are a well-heeled business interest, people should know that."

Politics and the Poor

Another emerging story concerns not what nonprofits are doing for politicians, but what politicians may do to nonprofits. Influential conservatives say charities have done such a superior job of caring for the poor, compared to government, that they should take over virtually all public aid. In 1996, Republican presidential contender Lamar Alexander called for government to get out of the welfare business and to encourage charitable donations by offering tax credits for charities that help the poor. Bob Dole later embraced the concept. The Lynde and Harry Bradley Foundation, which generously subsidizes a number of conservative groups, later gave Alexander funds to develop the idea. One pioneer in the new conservative charity movement, Marvin Olasky, argues that welfare aid is ineffective unless it is accompanied by a spiritual message. "You need both moral suasion and practical help, simultaneously," he said.

Charities do hope to take on more responsibilities for helping the poor. Many, however, say the conservative approach is questionable philosophically and potentially disastrous in practice. Sharon M. Daly, director of social policy for Catholic Charities USA, says it supposes that the poor are morally derelict. More than half the people her agencies serve are working. "They don't have character problems. They can't find jobs, or the wages they get are too low to support a family," she said.

The link between faith and sustenance worries some. "The nice thing about government is that it offers equality to all," said Evelyn Brodkin, a professor of social science at the University of Chicago. "If we go to a charity system, you'd better hope that there's a charity that likes people like you. Because if not, you have nowhere to go."

Even church-based charities leaders cite several reasons why they believe they cannot assume the nation's entire social welfare burden.

One is size. Catholic Charities USA, the nation's largest single charity, handles $2 billion in aid annually. The entire United Way, including everything from soup kitchens to Boy Scout troops, covers about $3 billion. Federal food stamp and welfare programs amount to $44 billion. Small size can be a blessing. It makes charities flexible and personal, said Daly. "We can do counseling, help people cope or get a job...but only if somebody else is making sure they're not starving in the streets. And there's no one more efficient than government at collecting revenues and getting checks to people."

U.S. Funds Still Sought

Many charities say that without government funding they could not provide even their current levels of service. The Independent Sector surveyed 108 charitable nonprofits and found that on average 32 percent of their funds came from government. To replace the social-services cuts once contemplated by Congress over the next seven years, each U.S. congregation would have to raise an extra $1.5 to $2 million. That would require an unprecedented 120 percent increase in private giving.

Conservatives say that money would flood into charities if government got out of the social welfare business. Many analysts disagree. Most studies show private donors would repay only pennies on every lost federal dollar, according to Virginia Hodgkinson, a nonprofit expert at Georgetown University. The most optimistic study predicted each lost federal dollar would be replaced with donations totaling 30 cents.

Moreover, there is no guarantee that the 30 cents would go where it is needed. Only 10 percent of all "charitable" donations go to help the poor, according to Julian Wolpert, an urban geographer at Princeton University. Most goes to services the donors themselves use: churches, schools, hospitals, arts and culture.

Even the purely charitable donations are spread unevenly. Across the nation, states where people support higher tax rates to help the poor also show higher rates of donation to charity. States with stingy governments have stingy donors, too. Within urban areas, suburban donors support suburban charities.

Inner-city charities can find themselves fiscal orphans. In Dallas, the inner-city food bank serves only 1 of 25 poor persons. Just across the city limits in the affluent suburb of Richardson, the food bank serves three of every four poor persons.

"As I talk to our local directors around the country, they are terrified by what is coming," said the Rev. Fred Kammer, President and CEO of Catholic Charities. "Because they see that the people they serve will have less income, and they will have fewer resources to meet their needs."

"Charities across the country are being asked to do more with less," said Cohen, who is Editor and Publisher of the Philanthropy Journal of North Carolina. "But most people don't know about it. It's not on their radar screen. Because the media don't write about it... The infrastructure never gets covered. And yet it's the biggest problem facing the sector."

Some members of Congress want to ensure that nonprofits do not fight too energetically for more aid to the poor. Rep. Ernest Istook, R-Okla., and other House Republicans have repeatedly tried to win approval of a bill that would bar lobbying by nonprofits that receive government funds. He says taxpayers should not have to support "groups that do not necessarily serve the interests of the general public." Nonprofit leaders note that Istook would not forbid businesses with government contracts from lobbying. In effect, he would permit wealthy businesses to lobby for themselves, but ban charities from lobbying on behalf of the needy.

Nonprofit analysts generally say that good newspapers are beginning to offer more nuanced coverage. The Aramony scandal opened editors' eyes. Special mid-career or journalism school courses have trained a cadre of reporters in the tricks of the nonprofit trade.

Yet all agree that the media have a long way to go.

Some say a "sacred-cow syndrome" still inhibits editors and reporters. "Both the press and the public tend to look away from problems that they stumble across," said one Kentucky reporter. "Because there is this feeling that, 'Oh, look at all the wonderful stuff they do. We don't want to rock the boat.'"

Others say the problem is not fear but sloth. "It's a matter of initiative," said Neill Borowski of The Philadelphia Inquirer,who co-authored a path-breaking series on nonprofits in 1993. Part of the problem, he added, is structural. Many good nonprofit stories fall between ordinary beats. University finances, for instance, are a great nonprofit story—but one that might not occur to an education reporter or to a business reporter.

"Nonprofits... are outside the usual beats and because they aren't government and don't hold meetings, most of the press don't cover them much," said Jim Aucoin, an Assistant Professor in the Communications Department of the University of South Alabama.

Improving coverage does not require creating a separate nonprofit beat, said Burnis Morris, a journalism professor at the University of Kentucky. After studying nonprofit coverage for five years, he concluded that papers simply need to do a better job of training reporters in what to look for, particularly questions of money, mission and capability. "Courthouse reporters need to know that they should look out for these stories, because a lot of them turn up at the courthouse," he said. "Sports reporters need to look.... I'm not calling for anything all that drastic. I'm just saying that journalists do what they are trained to do."

But, Morris adds, editors should bear in mind that the training may have to come on the job. He surveyed 87 schools of journalism and found that none used a textbook that taught about covering nonprofits. He asked professors if they supplemented the texts with their own materials on the agencies.

"Most professors said no," he said. "That's remarkable."

George Rodrigue, Nieman Fellow 1990, covers domestic policy issues for The Washington Bureau of The Dallas Morning News. He won a Pulitzer Prize for National Reporting in 1986. As The Morning News European Bureau Chief, he was a member of a reporting team that won the 1994 Pulitzer Prize for International Reporting.

George Rodrigue, Nieman Fellow 1990, covers domestic policy issues for The Washington Bureau of The Dallas Morning News. He won a Pulitzer Prize for National Reporting in 1986. As The Morning News European Bureau Chief, he was a member of a reporting team that won the 1994 Pulitzer Prize for International Reporting.