Clark Gilbert, an assistant professor at the Harvard Business School, studies entrepreneurship in large companies. In a recent study in which he worked with Clay Christensen, who has written about disruptive innovation, they spent two and a half years looking at the newspaper industry’s response to the Internet. The research included a field study of 18 leading newspaper companies and their Internet efforts (their names are disguised), followed by a statistical study of the 100 largest metropolitan newspapers in the United States (targeting the online general manager) and 71 interviews with people ranging from the chairman and CEO of each organization to the online general managers and sales staff. Observations and information from this study are described in the following edited excerpts.

Photo from the Library of Congress, Prints and Photographs Division.

Clark Gilbert: Let’s step away from the newspaper industry for a few minutes and talk a bit about what we see across industries around the theory of innovation. I’m going to draw on the research of Clay Christensen at the Harvard Business School, who started with the question of why great companies fail. What he found was “disruptive technology.” And in almost every case of disruptive technology, the established firm will not commit to it financially or operationally. A new entrant comes in before the established firm ever notices.

The example we use is Sony. When transistor technology comes in, the established players look at it and say, “Will it fit into the established market?” They all say no and reject it. It comes up, and Sony puts it into cheap, portable radios. The fidelity is terrible; it’s a junky, cheap toy. The established makers look at them and say, “These bums, they don’t know how to make anything.” But it has introduced new performance criteria. It’s portable. We can take it out of our house, away from our parents, and listen to our rock and roll music. Boom, a whole new market starts to grow up. The established players don’t see it for a long time. Then, when they do respond, their response is very rigid.

Framing a new business in the disruptive realm as a new opportunity means it is likely to suffer from chronic undercommitment. If it is framed as a threat, you’ll get aggressive commitment, but then those commitments will be deployed very narrowly around existing resources. The key becomes whether you can decouple the way you frame this business and how you allocate resources from the way you manage this business and the operating basis of the new venture.

In our study, we were looking at the language used to motivate resources from the senior management of the firm. What emerges was really a model of response. The first response was the core rejects the business: It just doesn’t make sense for good, rational managers, based on how they’re measured and used to making decisions, to respond. Threat then helps firms overcome this, but it creates rigidities around the product, the way it’s sold and the way it’s managed. (Firms that were separated out from the core organization and managed the business as if it was a distinct opportunity had much less rigid sustained response than those who kept it integrated and managed it as a threat to the core organization.) The threat orientation permeated everywhere in the organization. If the motivation to trigger resources was around threat, then that trickled down to the way it was managed.

RELATED ARTICLE

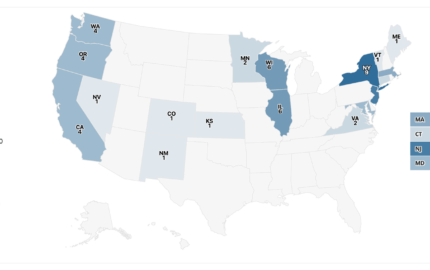

"Experiences with Internet Journalism"When we interviewed the top 100 online general managers in the fall of 2000 and asked, “Is the Internet a threat or an opportunity to your organization?” 54 percent said it was either an extremely powerful or powerful threat. When we looked at the top 100 newspapers (by circulation in 2000) and we asked them what percent of their site uses new or original content and what percent is lifted straight from the newspaper, about half said, “We take more than 75 percent of the newspaper content, and that is our product.” We saw kind of a dichotomy in the industry. Half the industry has a lot of new content on their sites; the other half was largely lifting this from the newspaper and putting it online.

We wanted to know what predicts traffic and innovation on the site. We wanted to look at the two variables—structure and whether management views this as a threat or an opportunity. (We controlled for things like market size; number of online employees, which was a proxy for spending; local Internet penetration, and launch date.) What we found was really incredible. Sites that were separated were more than double on the innovation metric. If you were separated from your print organization—everything else being equal—you had double the innovation on your site than your peer did with everything else equal on his integrated site. Second point was market penetration. Everything else being equal, the separated player had nearly four million pages per month more inventory than the integrated player. So you have the same number of employees, the same launch date, same market size, every other opportunity the same.

Then, we looked just at the separated sites. Even with the sites that were separated, if their managers continued to manage vis-à-vis the impact on print, they were less innovative and they had lower market penetration. So even if they had autonomy, if there wasn’t a mechanism for them to see this as something distinct, at least in an opportunity sense, they were much less innovative.

Readership overlap was surprisingly low. Sometimes it takes me hours working with print newspaper executives to get them to realize this, even when the data are in front of their faces. Four out of 10 newspaper Web site readers read the traditional print product; two out of 10 actually subscribe. The overwhelming growth is Web readership. More importantly, even where it overlaps, people use the online product much differently than they use the print. They use the online product as a utility, as a way to get access to quick information that’s useful in their lives. The overwhelming net use of all these sites, even the most local, small market ones, is that they create net readership.

The second thing is that the rates for advertisers are low. One online manager says that close to 90 percent of her customers are not print newspaper advertisers: “The sites gives us a valuable product and price point for advertisers that cannot afford the print product.” And from our field sites we asked, “Who are your top 25 print customers and top 25 online customers?” Out of a possible overlap of 200, there were seven. This gets back to the theory of disruption: Most people who’ve reacted to this—not just in the newspaper but in lots of established industries under disruption—fail to realize when the business starts that it creates net applications for different customers and new channels of revenue that just didn’t exist before.

The next thing is consumer intelligence: Half of the Web sites do not track any demographic data. Those that do have fewer than 10 percent of their users tracked. At one extreme is The New York Times, which is doing an absolutely fantastic job with demographic data; the paper gets 70 percent premiums on the ads they serve based on demographic targeting. On the other extreme is this rich, interactive, customizable product that you’re still getting published once and sending out to the world and denying the opportunity to serve advertising up in an individual, customized way.

Photo from the Library of Congress, Prints and Photographs Division.

Clark Gilbert: Let’s step away from the newspaper industry for a few minutes and talk a bit about what we see across industries around the theory of innovation. I’m going to draw on the research of Clay Christensen at the Harvard Business School, who started with the question of why great companies fail. What he found was “disruptive technology.” And in almost every case of disruptive technology, the established firm will not commit to it financially or operationally. A new entrant comes in before the established firm ever notices.

The example we use is Sony. When transistor technology comes in, the established players look at it and say, “Will it fit into the established market?” They all say no and reject it. It comes up, and Sony puts it into cheap, portable radios. The fidelity is terrible; it’s a junky, cheap toy. The established makers look at them and say, “These bums, they don’t know how to make anything.” But it has introduced new performance criteria. It’s portable. We can take it out of our house, away from our parents, and listen to our rock and roll music. Boom, a whole new market starts to grow up. The established players don’t see it for a long time. Then, when they do respond, their response is very rigid.

Framing a new business in the disruptive realm as a new opportunity means it is likely to suffer from chronic undercommitment. If it is framed as a threat, you’ll get aggressive commitment, but then those commitments will be deployed very narrowly around existing resources. The key becomes whether you can decouple the way you frame this business and how you allocate resources from the way you manage this business and the operating basis of the new venture.

In our study, we were looking at the language used to motivate resources from the senior management of the firm. What emerges was really a model of response. The first response was the core rejects the business: It just doesn’t make sense for good, rational managers, based on how they’re measured and used to making decisions, to respond. Threat then helps firms overcome this, but it creates rigidities around the product, the way it’s sold and the way it’s managed. (Firms that were separated out from the core organization and managed the business as if it was a distinct opportunity had much less rigid sustained response than those who kept it integrated and managed it as a threat to the core organization.) The threat orientation permeated everywhere in the organization. If the motivation to trigger resources was around threat, then that trickled down to the way it was managed.

RELATED ARTICLE

"Experiences with Internet Journalism"When we interviewed the top 100 online general managers in the fall of 2000 and asked, “Is the Internet a threat or an opportunity to your organization?” 54 percent said it was either an extremely powerful or powerful threat. When we looked at the top 100 newspapers (by circulation in 2000) and we asked them what percent of their site uses new or original content and what percent is lifted straight from the newspaper, about half said, “We take more than 75 percent of the newspaper content, and that is our product.” We saw kind of a dichotomy in the industry. Half the industry has a lot of new content on their sites; the other half was largely lifting this from the newspaper and putting it online.

We wanted to know what predicts traffic and innovation on the site. We wanted to look at the two variables—structure and whether management views this as a threat or an opportunity. (We controlled for things like market size; number of online employees, which was a proxy for spending; local Internet penetration, and launch date.) What we found was really incredible. Sites that were separated were more than double on the innovation metric. If you were separated from your print organization—everything else being equal—you had double the innovation on your site than your peer did with everything else equal on his integrated site. Second point was market penetration. Everything else being equal, the separated player had nearly four million pages per month more inventory than the integrated player. So you have the same number of employees, the same launch date, same market size, every other opportunity the same.

Then, we looked just at the separated sites. Even with the sites that were separated, if their managers continued to manage vis-à-vis the impact on print, they were less innovative and they had lower market penetration. So even if they had autonomy, if there wasn’t a mechanism for them to see this as something distinct, at least in an opportunity sense, they were much less innovative.

Readership overlap was surprisingly low. Sometimes it takes me hours working with print newspaper executives to get them to realize this, even when the data are in front of their faces. Four out of 10 newspaper Web site readers read the traditional print product; two out of 10 actually subscribe. The overwhelming growth is Web readership. More importantly, even where it overlaps, people use the online product much differently than they use the print. They use the online product as a utility, as a way to get access to quick information that’s useful in their lives. The overwhelming net use of all these sites, even the most local, small market ones, is that they create net readership.

The second thing is that the rates for advertisers are low. One online manager says that close to 90 percent of her customers are not print newspaper advertisers: “The sites gives us a valuable product and price point for advertisers that cannot afford the print product.” And from our field sites we asked, “Who are your top 25 print customers and top 25 online customers?” Out of a possible overlap of 200, there were seven. This gets back to the theory of disruption: Most people who’ve reacted to this—not just in the newspaper but in lots of established industries under disruption—fail to realize when the business starts that it creates net applications for different customers and new channels of revenue that just didn’t exist before.

The next thing is consumer intelligence: Half of the Web sites do not track any demographic data. Those that do have fewer than 10 percent of their users tracked. At one extreme is The New York Times, which is doing an absolutely fantastic job with demographic data; the paper gets 70 percent premiums on the ads they serve based on demographic targeting. On the other extreme is this rich, interactive, customizable product that you’re still getting published once and sending out to the world and denying the opportunity to serve advertising up in an individual, customized way.

- Ken Doctor is vice president/content services for Knight Ridder Digital.

- Clark Gilbert is assistant professor in the Entrepreneurial Management unit at the Harvard Business School, where he researches corporate innovation and the challenges of entrepreneurship in large, established firms.

- Bob Giles, a 1966 Nieman Fellow, is Curator of the Nieman Foundation.

- Teresa Hanafin has been the editor of Boston.com for three years, after 15 years at The Boston Globe.

- Rosabeth Moss Kanter is the Ernest L. Arbuckle Professor of Business Administration at the Harvard Business School.

- Philip Meyer, a 1967 Nieman Fellow, is a professor of and Knight Chair in Journalism at the University of North Carolina at Chapel Hill.

- Lisa Stone, a 2002 Nieman Fellow, is former editor in chief of original programming at Women.com, where she led daily programming and survey-assisted reporting.