Emily Corwin, NF ‘21, on how subsidies to create permanent jobs for the formerly incarcerated are doing the opposite

I stopped scrolling and squinted at Harvard’s course catalog, rereading the class title on the screen: “The Criminal Legal System as a Labor Market Institution.” I had reported on the criminal justice system for years and had set out to study the relationship between that system and economic inequality as a Nieman fellow that semester. Yet I couldn’t quite grasp what I was looking at.

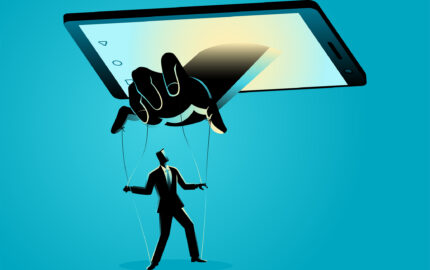

In class, sociologist Sandra Susan Smith explained how the government, through its criminal justice policies, impels workers with criminal records to accept jobs with low wages and poor working conditions, and creates a subordinate class of disproportionately Black workers whose desperation employers can exploit.

With funding for an investigative project from an Abrams Nieman fellowship, I set out to explore how the temporary staffing industry contributed to this dynamic. Over 13 months, I interviewed dozens of formerly incarcerated temp workers across six states, spoke to academics, service providers, and advocates, and dug into a little-known tax credit for businesses. The result was an investigation, published by ProPublica in August, which revealed how temporary staffing agencies — the employers of last resort for many formerly incarcerated workers — collect hundreds of millions in federal subsidies that were intended to promote permanent employment.

The reporting itself felt like walking through a fun house decked with trick mirrors. I was used to reporting on issues like elder abuse and discriminatory bail practices — things society agrees are problematic. This was different.

I spoke with temp workers who earned less than the colleagues they toiled next to and received no benefits or paid days off. Some described dangerous jobs they performed without training. Others had been stuck in temp work for more than a decade. Yet few would give me more than 10 minutes of their time. My biggest problem, I came to realize, was that most of these workers didn't think their circumstances were newsworthy.

So, I turned to the data, in particular the Work Opportunity Tax Credit, a longstanding federal job subsidy for employers of formerly incarcerated and other hard-to-employ workers.

I requested tax credit records from 50 states and received usable records from nine. An analysis showed that temp agencies were collecting nearly a quarter of these credits.

Publicly traded temp agencies’ SEC filings revealed that the tax credit had become an enormous windfall for the industry. As one economist explained to me, it was likely this program was contributing to the conversion of permanent jobs into temp work across the low-wage economy.

In other words, a program that was supposed to counteract the problems Smith’s class had highlighted was actually making them worse.

Tax credits aren’t sexy, but they are tangible. By revealing the failures of this program, I was able to illustrate the many ways the government – instead of improving poor work conditions – created a labor force willing to accept them.