While the #MeToo movement has highlighted the need to take sexual assault seriously, there hasn’t been the same kind of cultural reckoning concerning domestic violence. A study by James Alan Fox and Emma E. Fridel at Northeastern University found that 45% of women murdered in the U.S. between 2007 to 2016 were killed by an intimate partner. The statistic for men? Just 5%.

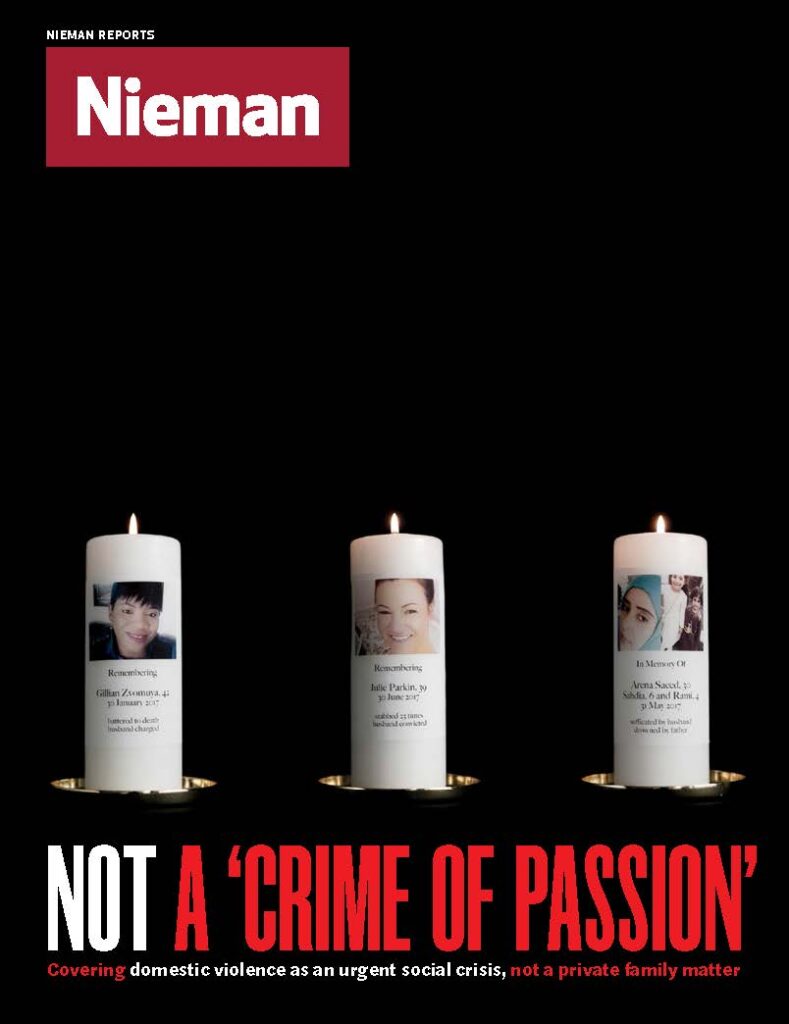

Too often, domestic violence has been covered as a private family matter, rather than as an urgent social crisis. Today more journalists are reporting with nuance and sensitivity on the complexities of the problem.

It’s all because more than two years earlier, I uncovered possible insider trading involving U.S. Representative Chris Collins’ pet Aussie biotech, Innate Immunotherapeutics.

This was simply good beat reporting. As a former business reporter working in Washington for The Buffalo News, I was the right journalist in the right place at the right time. Using company press releases, investor chat boards, and trading data to guide me, I could spot insider trading when it happened.

On June 21, 2017, Innate proudly announced that the Food and Drug Administration would allow it to begin research in the U.S. on its only product, an experimental drug for multiple sclerosis. But five days later, the company issued another press release saying clinical trials of that drug had failed in Australia and New Zealand.

My business reporting background told me that this meant Innate’s stock price would collapse and that Collins, a Buffalo-area Republican and at one point Innate’s biggest investor, would lose millions.

And thanks to my time as a business journalist, I knew all about “pump and dump” schemes, where companies hype their prospects days before releasing bad news, just so insiders can dump their stock before average investors can.

Talk of such a pump and dump scheme quickly filled an investors’ online chat room in Australia, so I wrote about it.

The next day, I found firmer evidence of insider trading. More Innate shares changed hands in the U.S. the previous Friday than in the previous 27 trading days combined, meaning someone had likely dumped their stock.

I highlighted that fact in a story in which Collins’ spokeswoman said no one in his family had sold any shares until after the company announced its only product was a failure.

That was a lie, one that federal prosecutors spelled out in an indictment 13 months later. Collins got the bad news about Innate in an email while at a White House picnic on June 22, 2017. He immediately called his son Cameron, who started dumping his shares in the following days while telling others to do so, too.

What lessons are there in this for other journalists?

First, cries of “fake news” are best met with a roll of the eyes. Collins called my stories just that in an August 2017 fundraising email. I ignored it and kept producing tough stories about him.

Second, in this age of shrinking staffs, my Collins coverage proves the value of the Washington beat, as well as the educational value of a few years covering business. Based on the drop in membership in the D.C.-based Regional Reporters Association, the number of reporters covering Washington for local news outlets may have plummeted by about two-thirds in 20 years.

Which prompts me to ask: how many members of Congress don’t have any reporters covering them the way I covered Collins? And are some lawmakers getting away with wrongdoing as a result?