It was the kind of story that editors might greet with a roll of the eyes and an everybody-knows-this reaction. But when it was published, “Making Ends Meet” — stories about the challenges facing working families — drew one of the strongest reader responses I’ve seen in nearly 15 years as a reporter.

When this series began, I was in my second year as a demographics reporter at the San Francisco Chronicle, working as part of a six-person team whose job was to produce stories about various racial and ethnic groups, as well as religion and demographic trends. My area of concentration was the African-American community. I also covered social services, which meant that routinely I’d receive reports on wages, housing costs, and the impact of political decisions on government assistance programs.

Sometimes I wrote stories generated by findings in these reports. But with the daily news-hole space tight, only so much could be addressed in a 12- to 20-inch story; a lot of background context and important voices in the debate about policy had to be left out. Among the lost voices were often those of people I interviewed whose lives were affected by the trends represented by the long lists of numbers in these reports. It’s fine to say, for example, that five in 20 people using daycare services are single mothers, but for the significance of these numbers to be absorbed, readers need to “hear” a single mother talking about her experiences. Second, many of these reports are done by groups leaning to the conservative or liberal side of the policy debate, and critics of their findings (and message) often brand these groups’ findings as biased attempts designed to skew data to further some agenda. Also, each of these reports usually examines only a small part of what is really a much bigger and more complex situation.

During a period of several weeks early in 2005, I received several studies from local and national advocacy groups and think tanks about cost of living increases and spending trends. That summer the federal government put out a series of trend reports compiled from new census data, including “Income, Poverty and Health Insurance Coverage in the United States: 2004,” and “Income, Earnings, and Poverty from the 2004 American Community Survey.” Neither report drew any sweeping conclusions, but the data were valuable enough to merit daily stories. And when combined with reports we’d received from the California Budget Project, among others, it became clear to me that there was enough valid data to draw some fairly good conclusions about trends affecting middle-class families and the working poor.

These trends were even more pronounced in the Bay Area, where housing and other cost-of-living indexes are among the nation’s highest. And these reports confirmed the expanding gap between those with higher and lower incomes, while middle-income families and the working poor are experiencing increased pressure in covering their major essential expenses, having lost economic ground since the 1970’s.

With this information in hand, I went to the Chronicle’s demographics editor and shared what I saw as the potential for a larger story, one in which these trends could be described and illuminated. She let me know that the cost-of-living pressures on working families were an issue she’d also been following with just such a story in mind. Once she gave me a green light for my reporting, I worked to develop a Page One story as quickly as I could to hook it to news from the recent release of the census surveys. But what was even more heartening was my editor’s expressed interest in having me do a second, more in-depth story about the economic squeeze on middle-class families. Although she gave me a general target length for both stories, her main message was to write whatever I had, and we’d deal with the story size later.

Families’ Experiences Illuminate the Numbers

View accompanying photos »With marching orders in hand, I started looking for people whose lives could flesh out the hard data about how working poor and middle-class families are falling further behind. I found many using sources and contacts I’d compiled from my beat reporting. I also tapped into a new database of readers that is part of the Chronicle’s Two Cents outreach feature. I drafted a message to explain what my story was about, and our Two Cents editor sent out an e-mail to readers whose contact information is in our database. I ended up speaking with a wide cross section of people — diverse in their ethnic and social backgrounds — from different parts of the nine-county Bay Area region. I also sought perspective on these trends from economic and social policy experts. Accompanying this reporting were compelling visuals, including photographs of family members whose lives I wrote about, as well as detailed graphics compiled by our art department.

Working on this story reminded me that one of the more difficult areas to probe in people’s lives is their personal finances, especially when that information might be published. This possibility made some families very nervous; one family pulled out of the story for this reason. Another family threatened to pull out but then changed their minds after we had a long talk one night. Often I had to go back to visit families to go over certain figures or get more information that they or I had forgotten to include in our earlier calculations.

Another challenge this story presented was a cautionary one: I wanted to write about these families in a way that didn’t say to readers “pity these poor people” or imply that they were victims of some conspiracy to crush the middle class. These stories would have the strongest impact, I believed, if they offered a straightforward account of what these people’s lives were like and if I could then fit their circumstances into a broader look at the nation’s economic and social trends.

Again and again, I heard — and told in my story — about the challenges posed by the high costs of housing and child care and escalating credit card debt caused by families using the cards to pay for what their paychecks could not cover. There were some emblematic moments that I think explain why this story succeeded in capturing the attention of so many readers. When a single mother who moved to a suburb of San Francisco because of rising housing costs in the city told of her long morning commute and the phone call she had with her 16-year-old son each morning to make sure he got up and off to school, her description captured what numbers and data could not. Similarly, the couple who spoke of the help their parents gave them so they could buy a house in a city where housing prices are sky-high touched a nerve with many who are living this same story. Several couples spoke of what their family life now looked like as they worked split shifts to cut down on child-care costs, and one just knew they were not alone.

I’d like to think that the approach we took to doing these stories and the space the paper devoted to them will have a lasting impact on the way such topics are covered on a daily basis. But I know the constraints of daily journalism can make this difficult. I believe that these articles — and the strong response they received — added to the consensus of opinion at the Chronicle about the importance of reporters seeking out the experiences of people whose lives are reflective of the numbers we convey. This is something many newspapers are doing, but there remains much room for improvement.

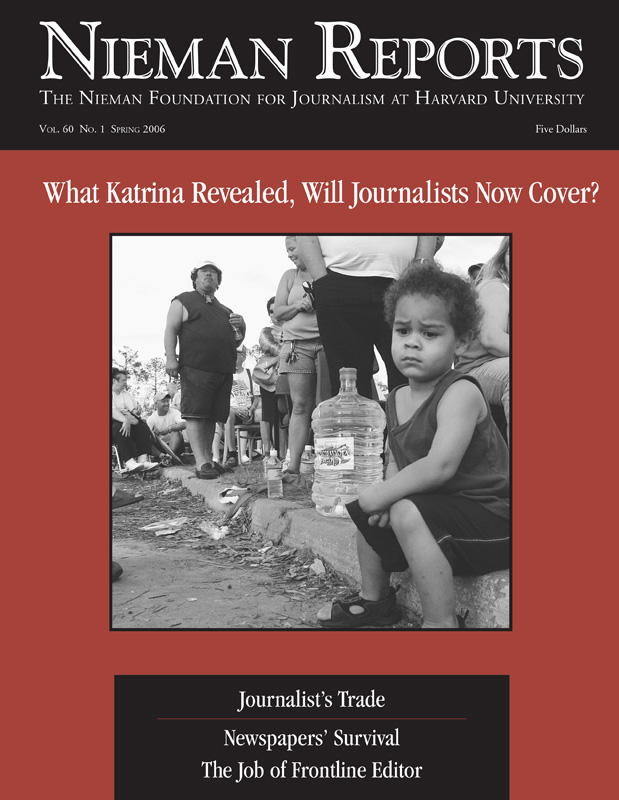

These photographs accompanied the San Francisco Chronicle’s article written by Jason Johnson about the economic squeeze on middle-class families.

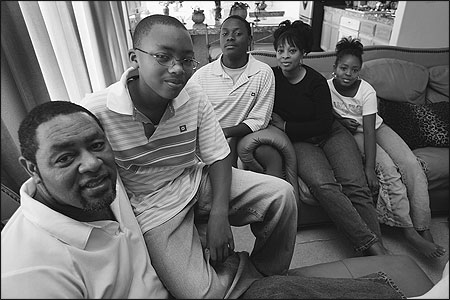

Kerry and Gina Morning with their three kids, Marzell, 11, Rahsaan, 15, and Sydney, 9, in October 2005 in Richmond, California. The family’s income plummeted when Kerry was injured at his job as an Alameda County probation officer. His $65,000 annual salary was replaced by a little under $3,500 a month in taxable disability payments. Gina Morning turned the odd jobs she did for extra cash into a business. She now makes about $20,000 a year staging children’s birthday parties, driving students to school, caring for kids during the summer, and sewing costumes and clothes with African-style prints. Photo by Paul Chinn/San Francisco Chronicle.

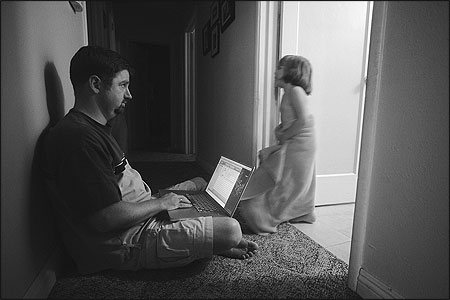

Patrick Campbell, 37, works on his laptop while he supervises bath time for his two daughters. Campbell and his family moved from San Francisco’s Noe Valley to San Jose three years ago so they could afford to buy a home. It was a small 1,100 square foot four-bedroom one-bath model costing $430,000, but at least it was theirs. A year later Patrick was laid off from his job at Silicon Graphics in Mountain View. The family struggled, but managed to keep it together as Patrick became a self-employed worker, with an annual income of about $80,000. But they’ve managed in part by racking up $8,000 in credit card debt and taking out a $46,000 line of credit on their home. Photo by Mike Kepka/San Francisco Chronicle.

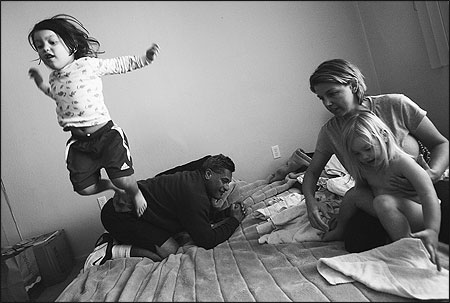

On the bed the whole family shares, Olive, 3, jumps off her dad, Lou Maunupau, 47. His wife, Claudia Vlasakova, 37, helps daughter Daisy, 2, fold laundry. Maunupau and Vlasakova live in San Francisco’s Sunset District, renting a small one-bedroom, almost like a studio, for $1,200 a month, for them and their two daughters. They have a combined income of a little over $52,000 a year, but find themselves struggling to make ends meet. They are an example of how many Bay Area families living well above the nation’s official poverty line find themselves cutting corners to afford the basics of food, housing, transportation and health care. Photo by Christina Koci Hernandez/San Francisco Chronicle.

Linda Knighten, 45, a single mom, gets up at 4:30 a.m. every day to travel from her home in Pittsburg, California to her job as a cook at Omni San Francisco Hotel. At 6 a.m. she calls home to make sure her 16-year-old son, David, wakes up and gets ready for school. Although Knighten makes about $40,000 a year and has her health insurance paid for by her employer, she finds herself in the red at the end of every month. Photo by Christina Koci Hernandez/San Francisco Chronicle.

Jason Johnson is a reporter with the San Francisco Chronicle.